What is the Advantage of Seller Financing for Sellers?

As you may well know we are currently in a frustrating market for Sellers.

If you are thinking of selling because you need a larger home or maybe you are downsizing and you are feeling discouraged about the current home values and high interest rates, you are not alone. Many sellers are struggling to sell their homes. They wished they would have put their home on the market a year ago when it was a seller’s market, when people were getting multiple offers; and selling within days of being listed.

AND, if you are like thousands of homeowners with a low interest rate, you are not thrilled about going and buying your next home with a 6 or 7% interest rate, or more.

The bad news it is no longer a seller’s market. The good news is that is that it is a great Seller Financing market!

What if we could show you a way that the seller could get more for their house in terms of a high price, even in this market? Maybe similar to what it was a year ago, and at the same time keep your low-rate mortgage and then transfer the benefit to their new home?

The bad news it is no longer a seller's market. The good news is that is that it is a great Seller Financing market!

Advantage #1

Advantage #2

2. Did you know that buyers looking to buy with a seller finance contract are willing to pay a higher price for your home if they can get the terms that fit their needs?

There are buyers right now who have good jobs, and large down payments but for one reason or another, can’t currently qualify for mortgages and would be happy to pay more to get into your house. Maybe they are self-employed, just changed jobs, have commission-based income, or maybe they just want a lower interest rate than a bank can give them.

Here is an example. The seller had a mortgage of $375,000. Comparable sales of three identical homes sold in the same area came in at $360,000. $15,000 less than what they owe. The sellers were behind on their payments and by the time they brought them current and paid for closing costs and realtor fees, they needed to sell their house for at least $400,000. They had a 3.52% interest rate on their mortgage, and they were willing to do Seller Finance. The Buyers negotiated an interest rate of 3.75% for 30 years. No balloon payment.

The house sold for $400,000. $40,000 above appraised value.

Because of the excellent terms, the buyer was willing to pay a higher price, and the seller was willing to accept the terms because he needed or wanted the higher price.

Imagine selling your home for more than the appraised price and then receiving monthly income after the sale for the term of the contract and extra interest on your equity, IN THIS MARKET!

Advantage #3

3. In addition to getting more than the appraised value, What if you could also receive a monthly residual income for the life of the contract. AND, keep your low-rate mortgage and transfer the benefit to your new home.

Sellers have two assets when selling their home. The house, and their low-interest mortgage. This is how it works:

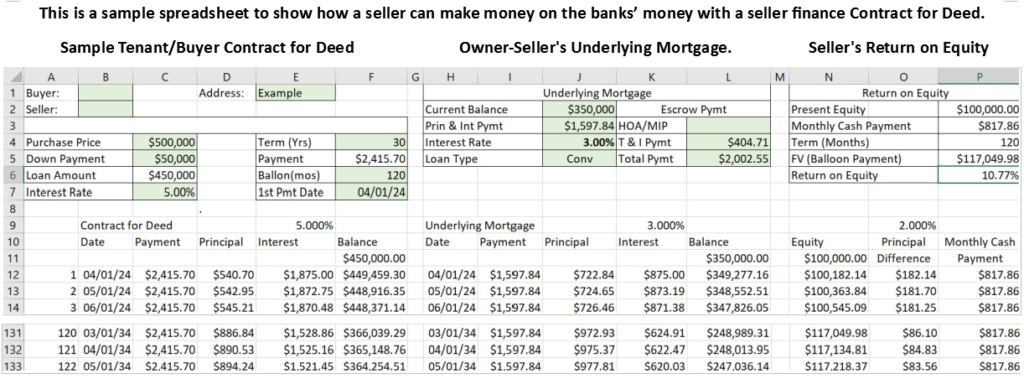

In this example, the mortgage on the property is $350,000. The interest rate is 3%. The sales price of the is $500,000. The down payment is $50,000. The Seller Finance Contract is 5% interest. The house was appraised for $455,000. There is a balloon payment due in 10 years. The seller’s equity is $100,000. That is the difference between the contract amount and the balance owing. The return on the equity for the Seller is 10.77%. That is not a bad interest rate. The Seller receives a monthly cash flow of $817.86

In Summary: The Seller sold their house for over the appraised value, is receiving $817.86 a month, and receives an equity payment of $117,049 when the loan is paid off in 10 years. That is an additional $17,049.

The question you need to ask is, “How much more did the seller receive by selling their home with a seller finance contract than if they had sold it with a traditional sale?” The answer is about 10% more than the appraised value, a monthly income of $817.86, and a bonus equity of $17,049.98

When we present this to clients they say, “Why aren’t more people using this technique?” The answer is Sellers don’t know that it is possible.

And…Most real estate agents and title companies don’t know how to properly do a Seller Finance Contract. My team of professionals has helped hundreds of sellers just like you.

Advantage #4

4. Faster closing.

Because you don’t have to wait for bank approval, many times, a seller financing contract can close as soon as 2 to 3 days.

Advantage #5

5. Seller financing buyers are not as picky on the condition of the home, or the location.

I find this to be a huge benefit for many sellers. Sometimes the reason they are on the market longer is because there are some issues in the house. Seller financing buyers who can’t qualify for a mortgage at the moment, frankly, are just anxious to find a seller who will offer seller financing. They are not as picky as to the condition as compared to a traditional buyer who can pick any house in their price range that is on the market.

So, there you have 5 good reasons to sell your home using a seller finanancing contract.

When we present this to our clients they say, “Why aren’t more people using this technique?” The answer is seller don’ know that it is possible.

Most real estate agents and title companies don’t even know how to properly do a Seller Finance Contract. My team of professionals has helped hundreds of sellers just like you.

For Frequently Asked Questions click HERE.

There is no cost or obligation to talk with us. Our purpose is to share with you the numbers that apply to your house and situation to see if it is something that might work for you.

To see a spreadsheet that would show you the cash flow and return on your equity for your situation, click on the link below.