What Is the Advantage of Seller Financing for Landlords

Advantage #1

Because of the increase in home values over the last few years this might be the right time for you to think of selling your rental property in installments and enjoy the monthly cash flow.

You, the investor, can be the bank and sell your investment property over time for full value and receive monthly cash flow for the term of the loan, which is generally 3 to 5 or as many as 30 years. It all depends on your future goals. This creates a cash flow for retirement that can be passed on to your heirs.

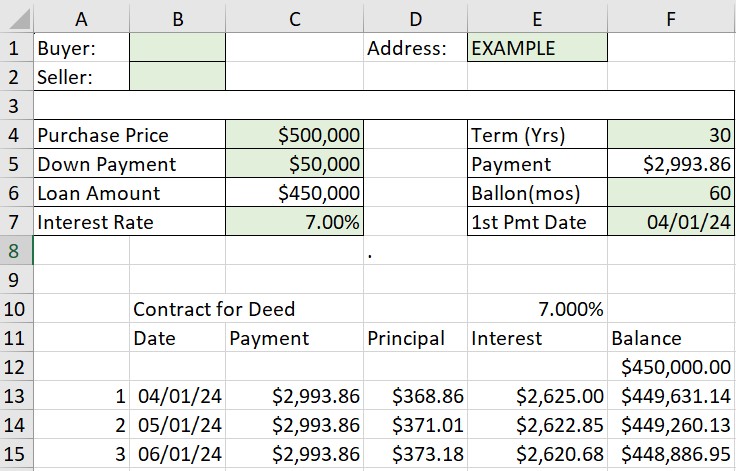

Here is an example of How Seller Financing Could Work for You.

Let’s assume that your investment property would sell for $500,000.00. If you use a seller finance Contract for Deed and charge 7% interest with 10% down. You will receive $50,000.00 up front and a monthly payment of $2,993.86 for as long as you want to hold the contract. You can have a balloon payment due in 5 to 10 years, but if you like the monthly income, you could hold it for 30 years. After 30 years you would have received $1,077,790.04 from the contract and $50,000 for the down payment for a total sales price of $1,127,790.04

Advantage #2

The tenant/buyer assumes all responsibilities for all maintenance, repair, property taxes, and insurance.

Buyers pay the taxes and insurance. Most importantly, they tend to take much better care of the home than renters because they have a vested interest in it now.

You may very likely make more money bottom line without the maintenance hassles and rental costs.

Seller Financing Cash Flow Worksheet

Monthly Rent Payment

Property Tax Divided by 12

Property Insurance Divided by 12

Yearly Maintenance Costs Divided by 12

Net Monthly Rental Cash Flow

$ ______________

$ – ______________

$ – ______________

$ – ______________

$ = ______________

If your Net Rental Income is less than your current monthly rent payment, Seller Financing might make sense for you.

Imagine having an investment property that pays you a regular monthly income, and interest on your equity, without worrying about taking care of tenants, taxes, or toilets.

Advantage #3

Capital gains on the sale of my investment property can be spread out over the years instead of paying them all at once.

When you sell your investment property the traditional way, you must pay 100% of the capital gains taxes in the year you sell. However, when you use a seller financing contract you can pay the capital gain taxes in the year you receive the payments using the installment method to spread them out over the loan term.

When we present this to our clients they say, “Why aren’t more people using this technique?” The answer is seller don’ know that it is possible.

Most real estate agents and title companies don’t even know how to properly do a Seller Finance Contract. My team of professionals has helped hundreds of sellers just like you.

For Frequently Asked Questions click HERE.

There is no cost or obligation to talk with us. Our purpose is to share with you the numbers that apply to your house and situation to see if it is something that might work for you.

To see a spreadsheet that would show you the cash flow and return on your equity for your situation, click on the link below.

What Are You Waiting For?

Fill out the information below to schedule a call.