Advantages of Seller Financing for Those Underwater - DONT DO A SHORTSALE

Are you underwater in your home? Do you owe more than it is worth?

This last year, many desperate buyers bought homes when it was a seller’s financing market where they bid up the price above the appraised value. So, for example, they bought a $500,000 home for $525,000. They came up with $25,000 out of their pocket because the house only appraised for $500,000. But they won the bid. That happened a lot.

Now, A year later the property has gone down in value. Now that house is only worth 450,000 and they need to sell. That is a classic underwater, short-sale situation. The current mortgage is higher than the net value of the home after they put it up for sale. And they have to pay the realtor fees and closing costs. They don’t have enough money at the end to pay off the mortgage. Or worse, the seller is behind on their mortgage payments. So that makes it even more difficult to sell. So, the payoff plus the back payments, plus the closing costs, make the price way too high for a traditional sale. This type of seller has no choice but to do seller financing.

Here is an example of how that would work.

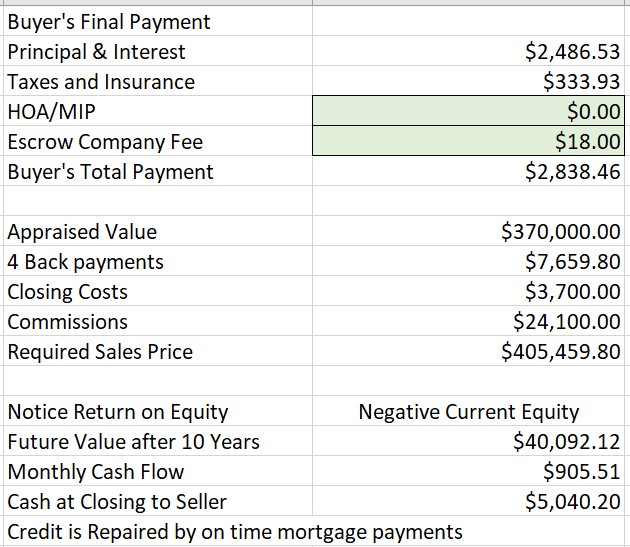

Here is a house that was appraised for $370,000. They have back payments of $3,829. They are going to have closing costs of $7,000. They are going to have commissions of about $2400. So, to make that happen, they are going to have to sell the house for $404,000, just so the seller can walk away with no other debt. Well, that is not possible because the current balance on their mortgage is $367,171. So, they are stuck. They will have to do a short sale.

There is an answer. They can do a seller finance contract and sell the house for $405,000. So, they got 10% down from my buyer which makes their contract for deed $364,500. And they are willing to pay a 7.25% interest rate. The seller’s interest rate is 3%. So, they are making 4.25% on the bank’s money. That would make the seller’s mortgage higher than the buyer’s contract. That is true. The buyer will need to be aware that their balance is lower than the underlying mortgage. So, if they were going to want to pay off the loan 6 months later, they would have to come up with an extra $400 to pay off their mortgage. So, to remedy this, I have a pre-payment penalty until payment number 8. The pre-payment penalty is essentially whatever the difference is between the mortgage balance and the contract for deed balance. After payment 8 there is no prepayment penalty because, at that point, the contract balance is higher than the underlying mortgage balance.

So instead of having a default, now I have a mortgage for my sellers that is going to be paid on time and I am going to help them repair their credit. That only takes 12 months. And in this case, this seller can’t qualify for another mortgage anyway, because they are behind on their payments. So, they are going to have to rent a house, buy a house on a seller financing contract, or move in with family. They are going to welcome a seller financing contract because it saves them from foreclosure or short sale. In addition, they are getting $905 every month in positive income.

Notice there is no calculation for the rate of return because initially, we started with a negative value. So, they had no equity. Once it switches to a positive, their rate of return is infinite, because they have no money of their own in this transaction. Are you okay with an infinite return on your investment? After 10 years, the seller would get $40,000 cash in their pocket.

So, they sold their home for more money than it was worth. They have a $ 900-a-month income. They didn’t have to do a short sale; their credit will be more easily repaired in 12 months, and they get $40,000 after 10 years.

Click on the link below to schedule a 30-minute Zoom call to find out how seller financing can work for you!